MrBeast Investigation

MrBeast's Alleged Cryptocurrency Involvement: An Investigative Overview

Jimmy Donaldson, widely known as MrBeast, the world's most-followed YouTuber with over 330 million subscribers and a net worth exceeding $500 million, is facing serious allegations of involvement in controversial cryptocurrency activities. According to an investigation published by on-chain analyst SomaXBT on October 11, 2024, MrBeast allegedly earned over $10+ million (Which Blockscope's research team found more than $20M) by promoting small-cap tokens such as SUPER, PMON, and SHOPX during their initial offerings in 2021.

The allegations suggest a potential pattern of early investments, aggressive influencer-driven hype, and strategic sell-offs, raising concerns about the ethical use of social media influence in cryptocurrency. Analysts, including SomaXBT and KasperLoock, identified over 50 wallets allegedly linked to MrBeast, suggesting an intricate network used to cover up insider trading and "pump-and-dump" tactics.

One key wallet attributed to MrBeast, 0x9e67D018488aD636B538e4158E9e7577F2ECac12, served as a focal point in these transactions.

The investigation emphasizes the potential risks associated with influencer-led promotions in crypto. It underlines how high-profile figures might knowingly or unknowingly exploit their reach to drive financial gain at the expense of unsuspecting investors.

Tracing MrBeast's Hive of Wallets

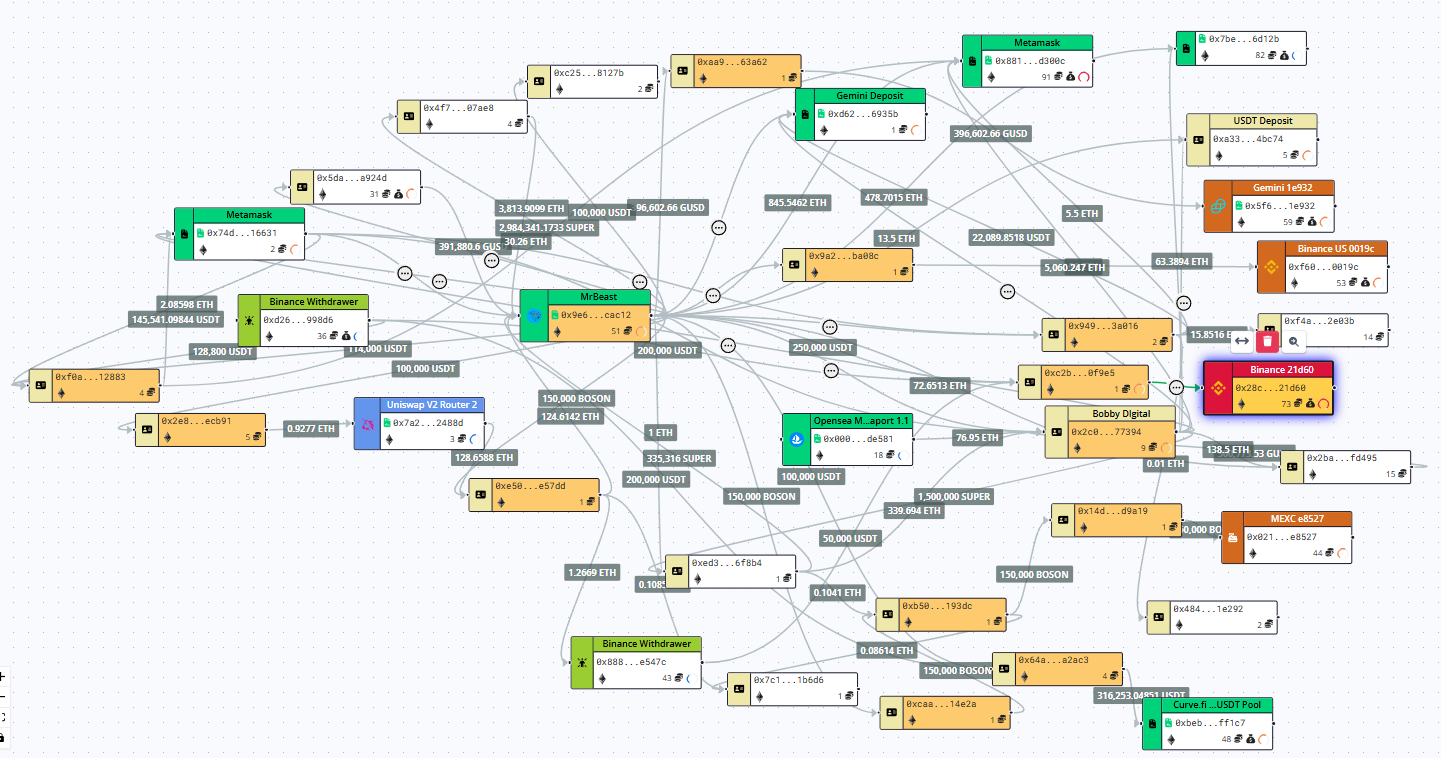

Our investigation reveals a fascinating but overwhelming network of wallets allegedly linked to MrBeast, which we’ve mapped using Blockscope Tracer. Dubbed the "Beast Hive," this network illustrates how influencers may orchestrate their transactions to maximize profits while avoiding detection.

There were a lot of tokens involved like ETH, USDT, GUSD, PEPE, USDC, AAVE, and many more including NFTs. Tokens like ERN, BOSON, SUPER, etc which were bought in pre-sale were cycled through multiple wallets before being sold, effectively obfuscating the trading patterns. Wallets in the Beast Hive often interact with each other in clusters, making it easier to distribute tokens and profits while creating a complex web of transactions.

Below is a screenshot of the 'Beast hive' where we found multiple wallets associated with MrBeast and can see some of them cashing out at various exchanges.

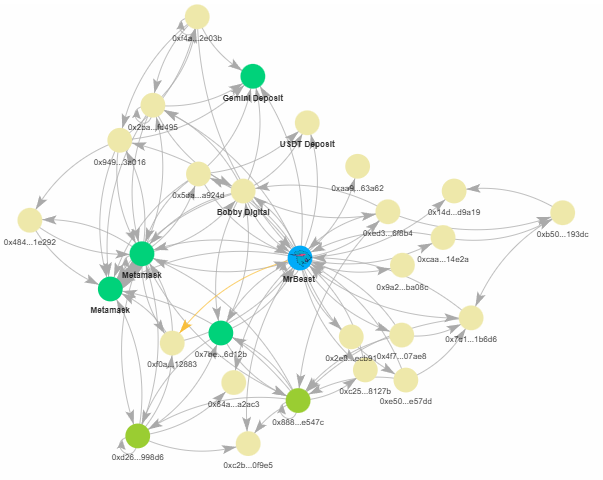

To further simplify and clarify the intricate network of wallets associated with MrBeast, we utilized Cohort analysis. This tool allowed us to isolate these cohorts so we can identify clusters of wallets that are most likely linked to MrBeast and track their shared activities.

Participation in Cryptocurrency Projects

As part of our investigation, we identified several cryptocurrency projects where MrBeast allegedly engaged in questionable trading activities. These projects, which include both tokens and NFTs, often involved strategic participation during pre-sales or initial offerings, followed by coordinated promotional efforts that inflated their market value.

The subsequent sell-offs traced to wallets linked to MrBeast have raised concerns about insider trading and market manipulation. Such practices undermine the integrity of the cryptocurrency market and place retail investors at risk of financial loss.

SuperVerse

$11M

FEB-OCT 2023

ERN (Ethernity Chain)

$4.6M

MAR-OCT 2021

AIOZ

$1M

APR-MAY 2021

Refinable

$200K

APR-MAY 2021

ShopX

$484K

MAR-NOV 2021

JIGSTACK (STAK)

$1.3M

MAY-JUL 2021

XCAD

$285K

MAY-JUN 2021

Polychain Monster (PMON)

$1.7M

MAR-MAY 2021

Boson Protocol (BOSON)

$615K

APR-JUL 2021

Standard Protocol (STND)

$130K

APR-MAY 2021

ALLY Direct (DRCT)

$200K

JUL-OCT 2021

Terona (CAPS)

$680k

2021-24

Metis L2

$660

2021-23

Source: SomaXBT, KasperLoock, Angelfacepeanut, Loock.io, and various other on-chain sleuths

In the following sections, we delve deeper into some specific projects, analyzing trading patterns, timelines, and financial outcomes attributed to wallets allegedly linked to MrBeast.